Top 10 Benefits of using Credit Cards for daily purchases

Table of Contents

Top Benefits of Using Credit Cards for Daily Purchases

Credit cards have become a common payment method for many people, and for good reason. They offer a number of benefits that can make them a valuable tool for managing your finances. Here are some of the top benefits of using credit cards for daily purchases:

1. Earn rewards

Many credit cards offer rewards programs that allow you to earn points, cash back, or travel rewards on your everyday spending. These rewards can be redeemed for a variety of valuable items, such as merchandise, gift cards, or travel.

2. Build your credit score

Using your credit card responsibly and making your payments on time can help you build your credit score. A good credit score can save you money on loans, insurance, and other expenses.

3. Fraud protection

Credit cards offer some of the best fraud protection available. If your card is lost or stolen, you are not liable for unauthorized charges. Most credit card companies will also reimburse you for any unauthorized charges that are made to your account.

4. Extended warranties

Many credit cards offer extended warranties on purchases made with your card. This can save you money on repairs or replacements if your purchase is damaged or defective.

5. Purchase protection

Many credit cards offer purchase protection that can reimburse you if your purchase is damaged or lost. This can be a lifesaver if you make a big purchase, such as a new TV or computer.

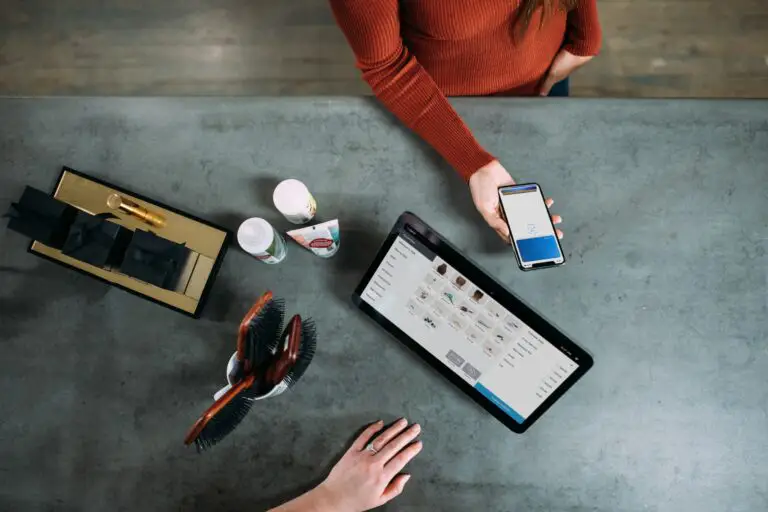

6. Convenience

Credit cards are a convenient way to pay for purchases. You can use them at most stores and online retailers, and you can also use them to withdraw cash from ATMs.

7. Budgeting tool

Credit cards can be a helpful tool for budgeting. By tracking your spending, you can see where your money is going and make adjustments to your budget as needed.

8. Grace period

Most credit cards offer a grace period, which is the time you have to pay off your balance before you start accruing interest. This can give you some extra time to pay off your purchases without incurring interest charges.

9. Consumer protections

The Fair Credit Billing Act (FCBA) and the Truth in Lending Act (TILA) provide consumers with a number of protections when using credit cards. These protections include the right to dispute charges, the right to cancel your card, and the right to receive a free copy of your credit report each year.

10. Security

Credit card transactions are very secure. When you use your card to make a purchase, your information is encrypted and protected by firewalls.

Here are some tips for using credit cards responsibly:

- Only charge what you can afford to pay off each month.

- Make your payments on time.

- Keep your credit utilization ratio low.

- Shop around for the best credit card rewards and interest rates.

- Review your credit card statement regularly.

- Report any lost or stolen cards immediately.

- Don’t give out your credit card information to anyone you don’t trust.

By using credit cards responsibly, you can enjoy the many benefits they offer without getting into trouble.

There are numerous way to do monetary transactions like paying by cash, through debit cards and using credit cards. Credit Cards offer better rewards to use it for our transactions. Apart from the rewards, credit cards provide many security features and protections plans to secure from fraudulent transactions, disputes or misuse from your card information.

How to apply for a Credit Card?

Not everyone can get a credit card, as it comes with certain trust and reputation from the individual. Credit Cards are basically a credit advance given to a person by Banks or financial institutions. It’s based on the agreement that the person who uses the credit will be paying it back within a stipulated time frame. In case if the person isn’t able to pay the money back, the respective financial institution will charge the individual with interest charge. These interest charges and fees are agreed by the card holder (Individual) and financial institution during the credit card application process.

Banks or financial institutions that provides the credit card makes the decision whether to approve a credit card application. It’s decided based on the individual’s credit worthiness. This is mostly decided by the individual’s credit score, credit utilization rate and some other factors. I’ll share those details elaborately in a separate post.

Things to be aware of Credit Cards

With all these advantages there are some key things that you need to be cautions. Credit Cards interest charges are higher comparing to any other loans or lending plans. So, if you miss paying it back before the due date, you might be charged with late fees and interest charges for the funds you used in that billing cycle. Another important factor is to keep track of all transactions being reported on your statement. If some of the transactions are not authorized ones, it’s the individuals responsibility to report it to the financial institution.

Final Thoughts on using Credit Cards

Credit cards can be a valuable tool for managing your finances, but it is important to use them responsibly. By following the tips above, you can avoid getting into debt and enjoy the many benefits that credit cards offer.

So I recommend you to start using credit cards if you’re using one right now. Feel free to share your comments and if you’d like me to post anything in particular about credit cards or related topic.